Oral health is closely tied to overall well-being. Employees with good dental health are less likely to suffer from conditions that affect their performance, such as untreated oral infections, gum disease, or even chronic illnesses like heart disease and diabetes. Did you know that untreated oral diseases cause over 164 million lost work hours each year in the U.S.?2 By providing dental insurance, you help your employees stay healthier and more productive.

How Providing Dental Benefits Helps Your Small Business Bottom Line

For small and medium-sized businesses, it is particularly important to bolster employee retention. That’s because training, turnover, and low productivity have a greater impact on a small business’s bottom line. But how does a business with a limited budget compete for talent in such a competitive job market?

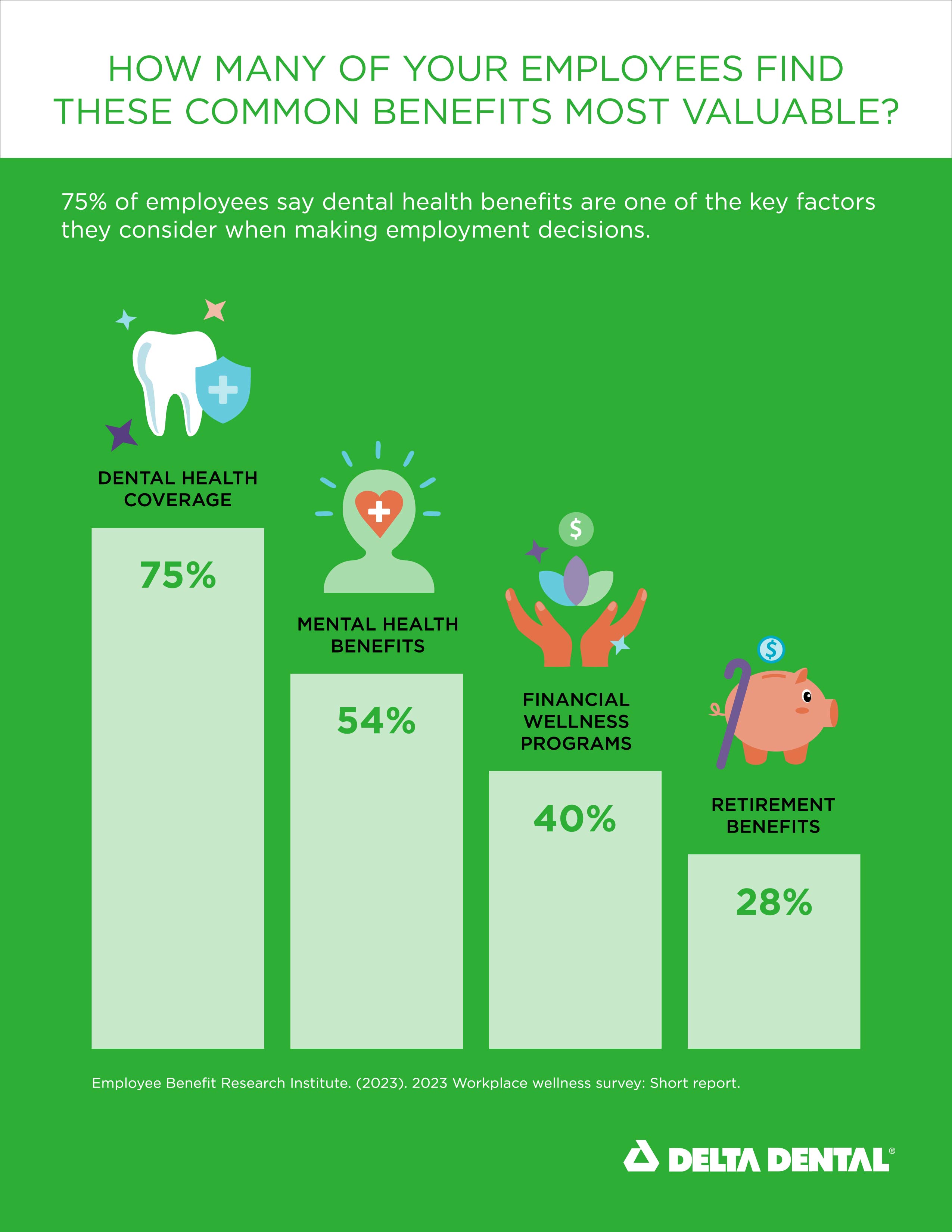

One highly effective benefit is often overlooked: dental coverage. Offering dental benefits not only supports your employees’ health but also provides significant advantages for your business. Research suggests that providing dental benefits has one of the highest returns on investment in talent acquisition and retention due to their relatively low cost and high impact on a person’s decision to stay with a company. 1

5 ways this affordable benefit can help your small business thrive.

Dental insurance also plays a key role in the prevention of chronic diseases. Research shows that conditions like heart disease and diabetes are connected to poor oral health. By encouraging employees to maintain regular dental check-ups, you reduce the likelihood of costly medical complications, meaning fewer sick days and a healthier workforce.

One of the most attractive aspects of dental insurance is its affordability. Dental coverage is at the low end of the average cost of employee benefits. The cost per employee is as low as $2 per day, a fraction of what medical insurance costs3. Despite this low price, dental benefits are highly valued by employees—62% consider them a “must-have” benefit, according to a MetLife study1 . For small businesses looking to maximize their benefits budget, dental insurance offers one of the best returns on investment.

Losing an employee can be disruptive and expensive. Offering dental benefits shows employees that their well-being is a priority, which helps foster loyalty. According to a Gallup study, employees who feel that their company cares about their health are more likely to stay4. This means that offering dental insurance could reduce turnover and help you retain your skilled workforce.

To fully benefit from offering dental insurance, it’s important to communicate its value clearly to employees. Regularly share details about what’s covered and how they can make the most of their plan. This helps ensure they take advantage of the benefit and reinforces your company’s commitment to their health and well-being.

Premium sharing for small and medium sized businesses

Some businesses may choose to pay for most of an insurance plan’s cost. But there are plans that can be offered where the employer pays minimal or even nothing at all. Often called Voluntary plans (employees volunteer to participate), employees can take advantage of being a part of the group and get plans cheaper than they would on their own, while the employer keeps their costs low. The employer can pay as little as $0 toward coverage but can also chip in to make the plan more affordable for employees. For instance, if a plan costs $50 per month for an employee, the employer could pay $25, allowing employees to buy for only $25 per month. Voluntary plans are rare in medical coverage but are often offered in dental and vision coverage.

Insurance companies usually charge less for plans when the business helps to pay (that gets more low-cost users to sign up). However, even with employer-paid plans, there is opportunity for premium sharing. Some employers pay 100%, but a typical plan would only require about 75% of the employee costs to be paid by the employer. Employers can also contribute to the costs of spouse or dependent coverage as well. Employers may adjust these contribution amounts year over year to optimize costs.

These plans allow you to choose the level of coverage that works best for your workforce without breaking the bank.

There are great small business dental plan options

When it comes to providing dental benefits, small businesses have a wide range of options. Whether you’re looking for basic coverage or a more comprehensive plan, Delta Dental of Washington offers a variety of small business dental plans that can be tailored to fit your budget and the needs of your employees. Providing dental benefits to your employees is not just a nice-to-have—it’s a strategic move that supports the growth of your business. By improving employee health, reducing absenteeism, and enhancing loyalty, dental insurance can contribute to a stronger, more successful business. In a competitive job market, offering dental benefits helps you stand out and positions your company as an employer of choice.

Start growing your business today by prioritizing dental benefits for your team!

Explore plans

To view custom plans and pricing, simply complete this form and get a link right away.

*By providing your email or phone number you agree to be contacted by Delta Dental of Washington. Carrier rates may apply. Consent to receive marketing communications is not required to purchase any policy. *Prices are estimated employer cost per employee per month and may not include employee contribution. Already have a broker? Please reach out to them directly for a quote.

1 MetLife. 2024 U.S. Employee Benefit Trends Study. MetLife, 2024.

2 The Kaiser Family Foundation. 2023 Employer Health Benefits Survey, 2023. https://www.kff.org/report-section/ehbs-2023-section-1-cost-of-health-insurance/

3 Delta Dental. Delta Dental Small Business Benefits Research. 2022

4 Gallup. Percent Who Feel Employer Cares About Their Wellbeing Plummets, 2022. https://www.gallup.com/workplace/390776/percent-feel-employer-cares-wellbeing-plummets.aspx